The financial world is experiencing a seismic shift as trillions of dollars change hands in what is called the “Great Wealth Transfer.” Central to this trend are ‘money-in-motion’ events, moments when an individual’s financial circumstances change significantly, creating opportunities for financial advisors. This article delves deep into the world of money-in-motion, exploring its significance, the technology driving its detection, and how forward-thinking platforms like Wealthfeed are changing the game for financial professionals.

UNDERSTANDING MONEY-IN-MOTION: A PARADIGM SHIFT IN WEALTH MANAGEMENT

The upcoming Great Wealth Transfer offers a rare opportunity for advisors to build relationships with millennials and pre-retiree women who are set to inherit substantial wealth. With 81% of inheritors expected to seek financial advisory services, it’s essential to develop strategic marketing plans that emphasize trust and professional expertise.

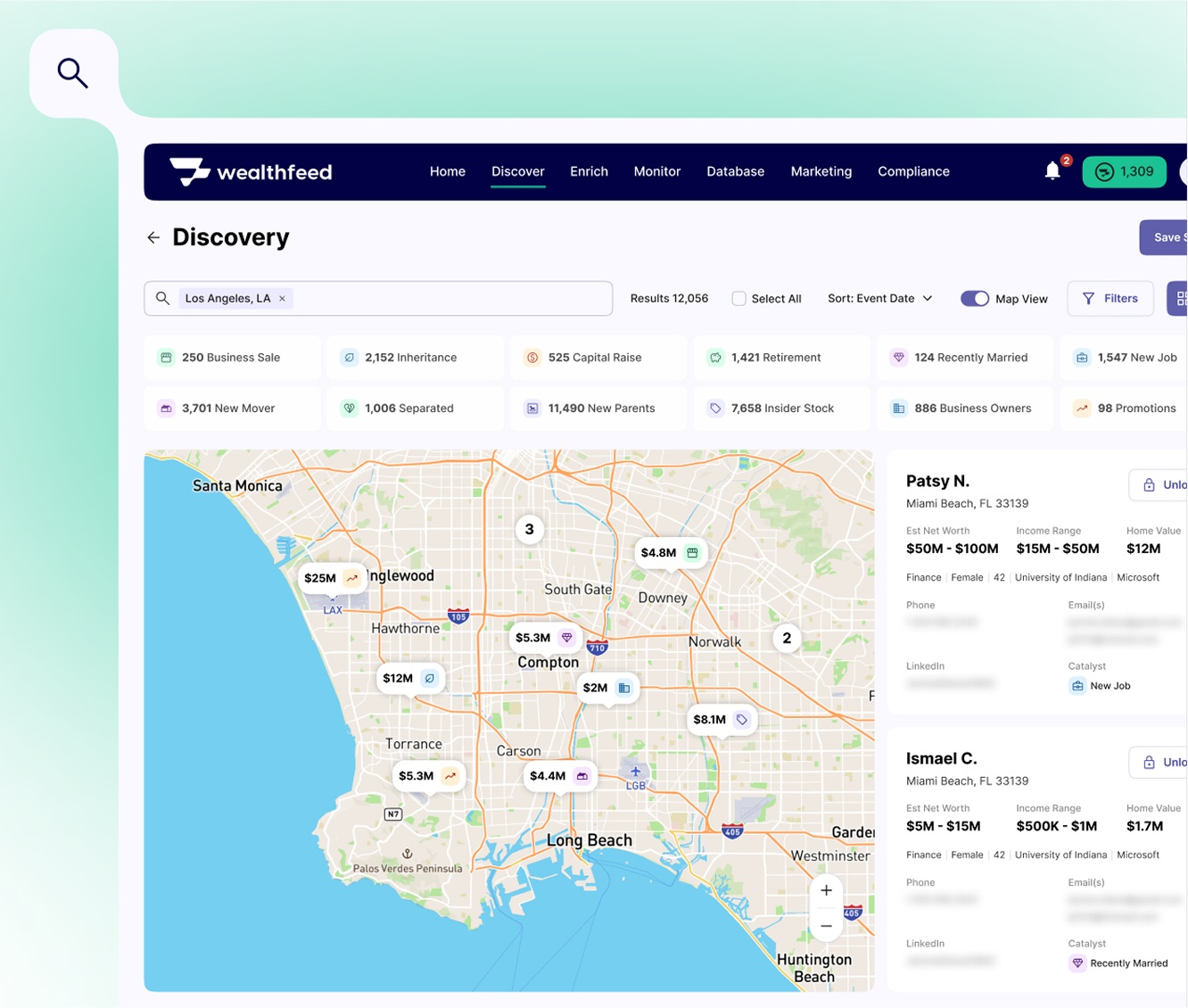

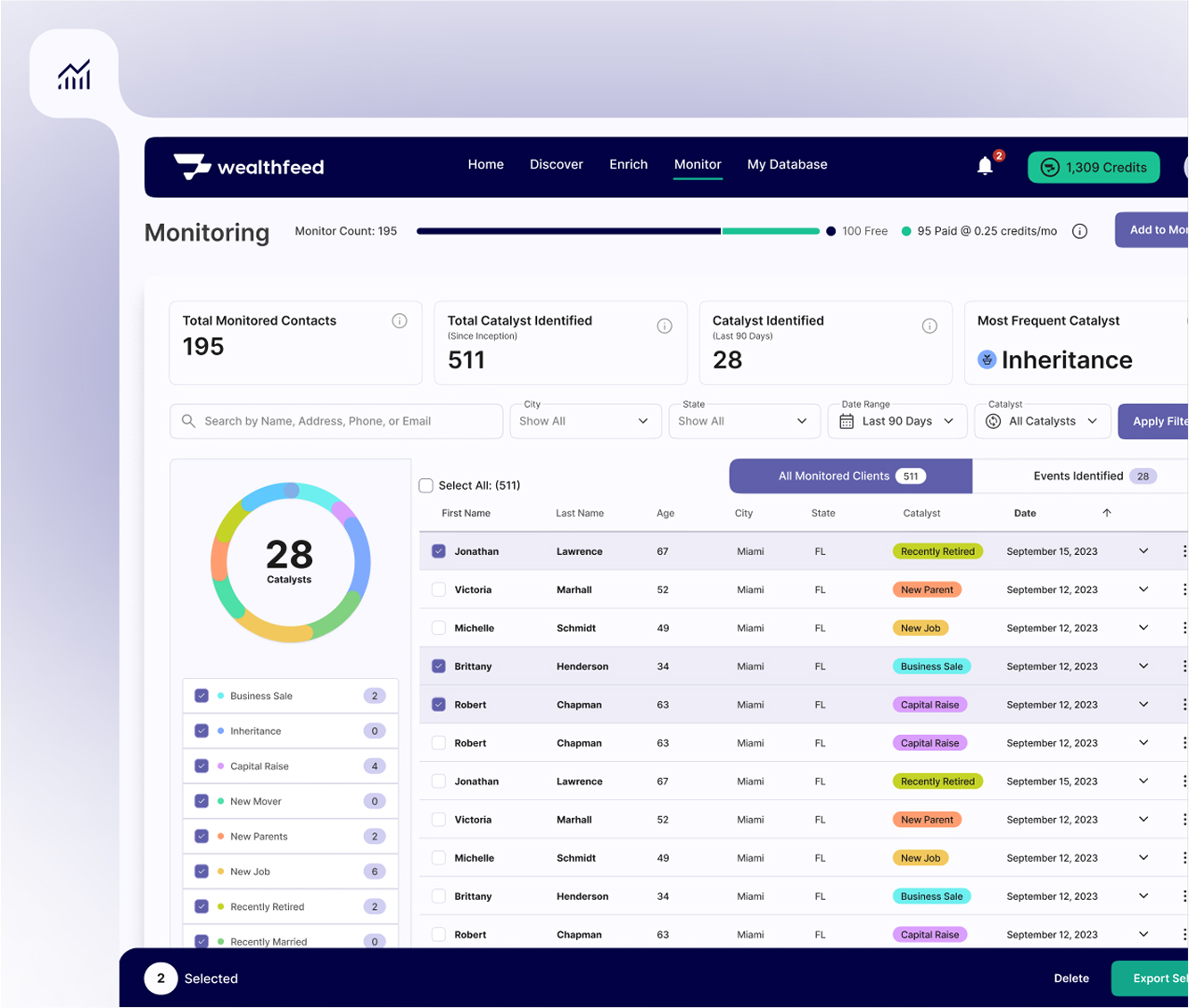

“Money-in-motion” refers to pivotal financial events—like inheritances, career changes, divorces, and retirements—that cause asset reallocations. Advisors who can detect these high-value events, especially amid the projected size of wealth being transferred, can secure valuable client relationships and expand their practices.

For instance, Cerulli Associates estimates that $68 trillion in wealth will transfer between generations over the next 25 years. These events come in various forms, each presenting unique opportunities and challenges for financial advisors: Inheritance, Career Changes, Divorce or Marriage, Real Estate Transactions, Retirement, Business Sales or Acquisitions. Each of these events represents a period of financial flux when individuals are most open to seeking professional advice and potentially revising their financial strategies. The challenge for advisors is to identify these opportunities at the right time.

THE AI REVOLUTION: HOW TECHNOLOGY IS UNCOVERING HIDDEN OPPORTUNITIES

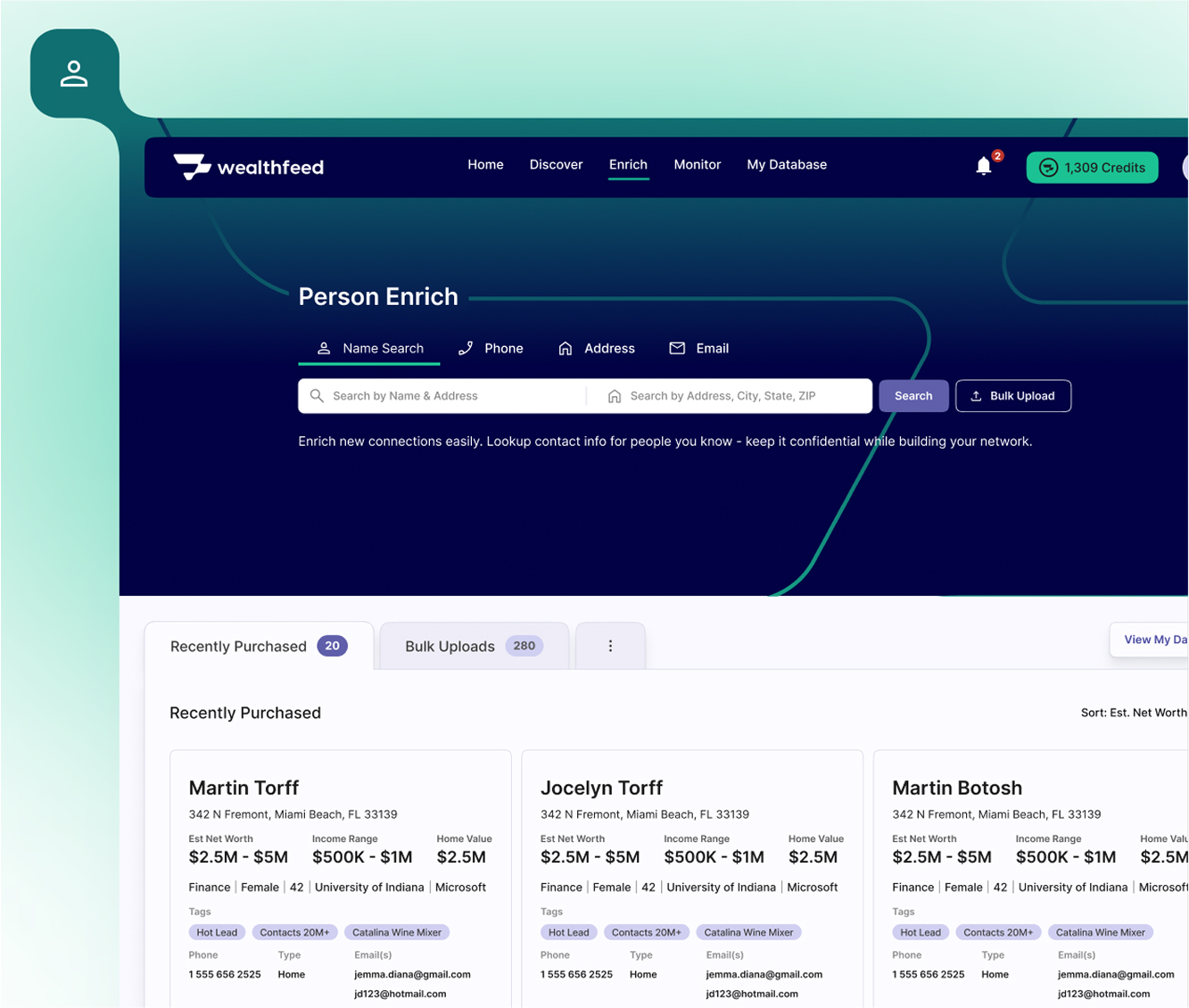

In the past, identifying money-in-motion events relied heavily on personal networks, centers of influence, word-of-mouth referrals, and labor-intensive prospecting methods. Today, artificial intelligence and machine learning are transforming this process, enabling advisors to detect and act on these opportunities with unprecedented precision and scale.

AI-powered platforms leverage vast amounts of data from various sources, including:

● Public records

● Social media activity

● News articles

● Economic indicators

● Demographic trends

By analyzing this data, AI algorithms can identify patterns and signals that indicate potential money-in-motion events. For instance, a change in job title on LinkedIn, a real estate transaction recorded in public records, or even subtle changes in social media behavior can all be indicators of underlying financial shifts. The power of AI in this context cannot be overstated. It allows advisors to move from a reactive to a proactive stance, reaching out to prospects at precisely the right moment with tailored solutions. This level of timing and personalization was simply not possible at scale before the advent of AI-driven lead generation tools.

THE MARKETING ADVANTAGE: WHY PROACTIVE ADVISORS WIN MORE BUSINESS

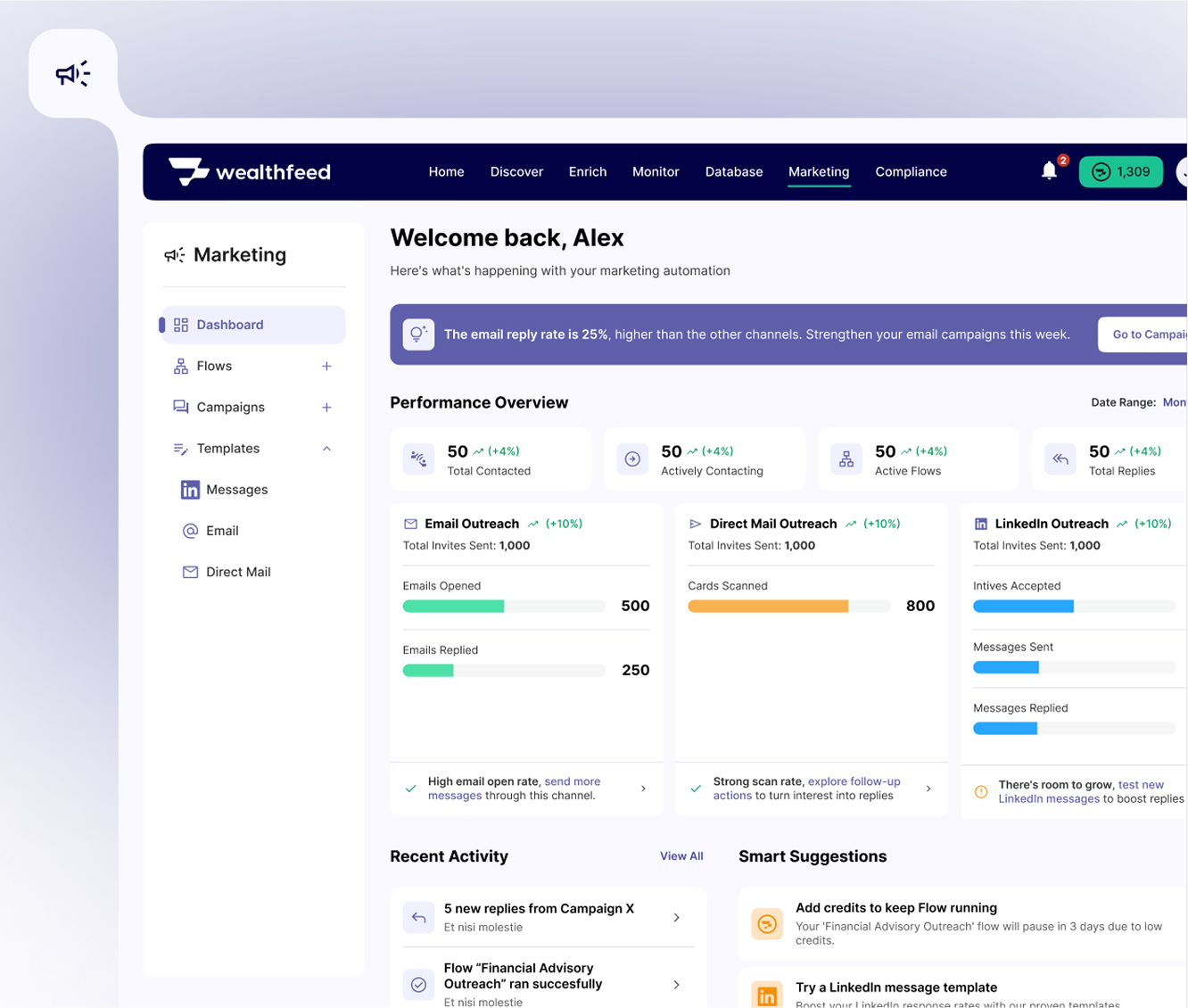

In the competitive world of financial advisory, being first to market can make all the difference. Advisors who leverage AI-powered insights to identify and act on money-in-motion events gain a significant edge over their peers. Here’s why:

1. TIMING IS EVERYTHING

Reaching out to a prospect in the midst of a significant financial event demonstrates foresight and positions the advisor as a proactive problem-solver rather than just another service provider.

2. PERSONALIZED APPROACH

Armed with insights about the specific financial event a prospect is experiencing, advisors can tailor their outreach and proposed solutions, increasing the relevance and appeal of their offerings.

3. TRUST-BUILDING

By demonstrating an understanding of the prospect’s current situation, advisors can quickly establish credibility and trust, which are crucial in the financial services industry.

4. COMPETITIVE DIFFERENTIATION

In a sea of financial advisors all vying for attention, those who can consistently identify and act on money-in-motion events stand out as innovative and client-focused.

5. HIGHER CONVERSION RATES

Prospects are more likely to engage with and ultimately choose an advisor who reaches out at a time when they are actively seeking financial guidance.

The data supports this approach. According to a study by Kitces Research, advisors who actively market their services grow 2-3 times faster than those who rely solely on referrals. When this proactive marketing is powered by AI-driven insights into money-in-motion events, the potential for growth is exponential.

TAKE THE NEXT STEP: EXPERIENCE THE WEALTHFEED ADVANTAGE

Eager to shake up your strategy for prospecting? Uncover the secret power of Wealthfeed, the tool that turns money-in-motion events into a treasure trove for your business. Why watch chances pass you by?Dive into a demo today and embark on a journey towards a future in wealth management that thrives on proactivity and data. Reach out to Wealthfeed now, book your customized demo, and harness the transformative force of AI-driven lead generation for your financial advisory practice.